Group Critical Illness Insurance

Protection for employees and their families. Helps lessen the financial impact of out-of pocket medical costs related to serious illness or health event.

|

Plan Summary

|

Dependent coverage

|

-

- Lump sum benefit paid directly to claimant

- Annual wellness benefit for all individuals ($50)

- Spouse coverage available when employee participates in plan

- Children covered automatically at 50% of employee benefit at no additional cost

Unum Critical Illness Overview

RESOURCES

Group Accident Insurance

Protection for employees and their families

|

|

Unum Accident Overview

RESOURCES

Group Hospital Indemnity

Protection for employees and their families

- Medical insurance covers many of the costs associated with a hospital stay and outpatient surgery, but you could still be left with significant out-of-pocket expenses

- $1,000 for a covered hospital admission once per calendar year

- $100 for each day of your covered hospital stay to a maximum of 365 days per calendar year

- $100 for each day you spend in intensive care up to a maximum of 30 days per calendar year

- No issue age restrictions for employee

- Spouse: Issue ages from 17 – 64

- Dependent Children: Newborn to 26th birthday

- Coverage is portable

Unum Hospital Indemnity Overview

Hospital Coverage (Bi-Weekly Cost)

*Note: Family Coverage Options assume Employee and Spouse are in the same Age Band. If Employee and Spouse are in different Age Bands, the final Monthly Premium amounts will be different.

RESOURCES

Wellness Benefit for Accident, Critical Illness, and Hospital Indemnity

Each covered individual will automatically receive the health screening benefit rider, which can pay $50 annual for a covered health screening test. The wellness benefit is included with the Accident, Critical Illness coverage AND Hospital Indemnity. If you and/or a dependent enroll in both coverages, you can receive a $50 wellness benefit for each plan for a qualifying health test/screening (for a maximum of $150 per covered individual per calendar year). Some covered tests include:

|

|

RESOURCES

LegalShield/IDShield

Legal Services Plan providing support for will preparation, POA, Identity Theft and much more!

FAMILY PRICE $8.54 PER PAY

- Dedicated Law Firm with Direct access, no call center

- Legal Advice/Consultation on unlimited personal issues

- Letters/Calls made on your behalf

- Contracts/Documents Reviewed up to 15 pages

- Residential Loan Document Assistance for the purchase of your primary residence

- Will Preparation – Will/Living Will/Health Care Power of Attorney

- Traffic Ticket Consultation (15 day waiting period)

- IRS Audit Assistance – Begins with the tax return due April 15th of the year you enroll

- Trial Defense – If named defendant/respondent in a covered civil action suit

- Uncontested Divorce, Separation, Adoption and/or Name Change Representation

- Available 90 days after enrollment

- 25% Preferred Member Discount – Bankruptcy, criminal charges, DUI, personal injury

- 24/7 Emergency Access for covered situations

- Visit the LegalShield site for more info benefits.legalshield.com/victorycap

ARE YOU PREPARED?

Below are some resources, provided to us by our benefits partner, LegalShield, to help to educate you about the importance of Will preparation and estate planning.

We encourage you to spend a little time reviewing these two documents and addressing this important topic. For employees enrolled in our LegalShield program through VCM, Will Preparation is a covered service and your provider law firm can help answer any specific questions and create your personal estate planning documents.

If you are not currently enrolled in a LegalShield program, you can consider doing so during our next open enrollment period.

RESOURCES

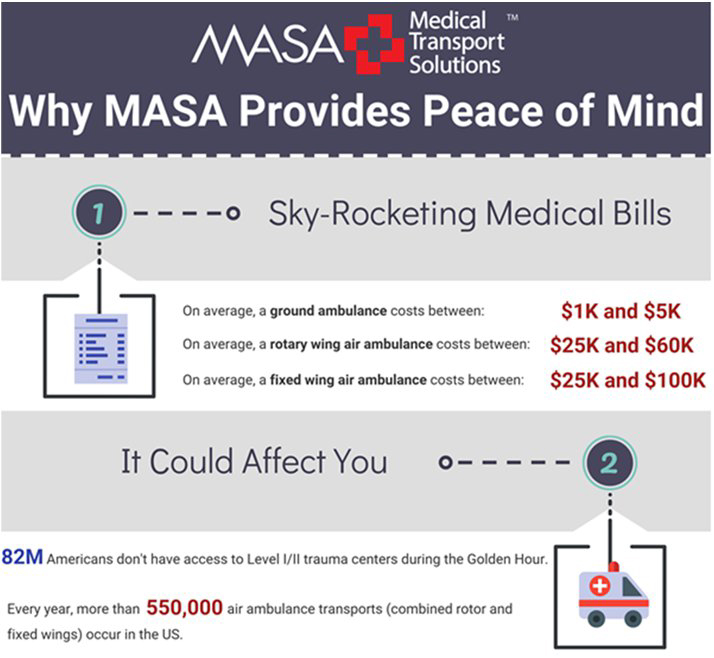

Medical Transport Solutions

Peace of mind to know you have protection from skyrocketing ambulance bills & balance-billing from non-network providers.

Purchase protection for your entire family:

platinum: $18/Bi-weekly

Emergent Premier: $8.76/Bi-Weekly

Emergent plus: $6.46/bi-weekly

RESOURCES

Genomic Life

Because Cancer is too BIG to risk going it alone. Cancer Guardian is a transformative benefit program that combines the power of advanced DNA testing with the personalized support of expert cancer care resources.

- Cancer Information Line

- Hereditary Risk Screening Test

- Medical Records Platform

- Dedicated Cancer Support Specialist

- Expert Pathology Review

- Comprehensive Genomic Profiling

- On-site Nurse Advocate

- Clinical Trial Explorer

- Financial Navigation

Bi-Weekly Cost

*Note: Dependents under the age of 26 are automatically covered if employee elects coverage,

they will not have access to hereditary testing.

RESOURCES

Term Life/AD&D

If you purchase Supplemental Life Insurance for yourself, your spouse and dependents, you get:

- Group discounted rates

- To purchase AD&D coverage (for employee supplemental life only). AD&D can be purchased independently of Life insurance.

- To purchase up to $750,000 in coverage — Any coverage in excess of $280,000 will require completion of Evidence of Insurability

- To purchase up to $250,000 in spouse life insurance— Evidence of insurability required for any amount over $50,000

- To purchase up to $10,000 in life insurance for your child(ren)

- Evidence of Insurability will be required if purchasing coverage outside of initial eligibility period

Don’t forget to designate a beneficiary for employee life insurance.

Supplemental Life and AD&D and Dependent Life Rates Monthly cost per $1,000 of coverage

*Note: Family Coverage Options assume Employee and Spouse are in the same Age Band. If Employee and Spouse are in different Age Bands, the final Monthly Premium amounts will be different.

RESOURCES

Whole Life

Get lifetime coverage and useful cash benefits, too.

Provides much more than a death benefit- it also offers valuable “living benefits” that you can use during times of need.

- Employee: $3 -$20 weekly*

- Any amount over $10 weekly is medically underwritten

- Spouse: $3- $10 weekly*

- Child: $3 Weekly

- Child Term Rider: $10,000

You can only enroll in Whole Life during VCM’s Annual Open Enrollment period.

RESOURCES

Pet Insurance

Fetch the best health coverage for your pet through y our voluntary benefits package. Nationwide pet insurance helps you cover veterinary expenses so you can provide your pets with the best care possible – without worrying about the cost.Policies are available for dogs, cats, birds, reptiles and other exotic pets.

Employees can enroll anytime throughout the year by visiting https://benefits.petinsurance.com/vcm or by calling our New Enrollment Specialists at 877-738-7874 and stating that they are Victory Capital Management employees.